In India, only 4% of people invest in the stock market, while in Western countries the number is huge. In the case of the United States, it is about 50% of people invest in the stock market and trade daily. So here we will discuss stock market information in deep and its terms.

So what are the reasons for fewer people investing in the stock market in India or other South Asian countries:-

- Basically, they have less knowledge about the stock market.

- Also less dedication towards the economics market.

- No risk-taking ability in stock trading.

- Some people are scared of frauds and scandals.

So let's start with the basics of the stock market:-

There are two important words in the stock market demand and supply.

What are the fundamental rules of demand and supply?

If demand increases supply is less and if supply increases then demand decreases.

There are 2 types of stock:-

- Common Stock

- Preferred Stock

There are basically four types of exchanges:-

- NSE National Stock Exchange

- BSE Bombay Stock Exchange

- MCX Multi commodity exchange

- NCDEX National commodity and derivatives exchange limited

|

| Types of Exchange |

In the stock market, we buy and sell shares of the company, i.e we are a little part of the company. Stocks are nothing but shares and membership of the company which makes you part of the company, also you get some rights in the company.

Before 1996 when we use to buy shares total paperwork was there. In 1996 the revolution came and it continued into dematerialized form. Today it is known as a Demat account and for this broker it mandatory compulsory.

The stock market risks no doubt, but when invested in a proper manner and discipline structure you can earn in crores. Believe me, this only field in the world that can let you become a Billionaire just from Mobile and Laptop. Learn fundamental and technical knowledge and also watch stock prices of today’s market.

PE, Nifty 50, Sensex?

What is PE?

It is the price earning ratio. Expert says that if PE is below 10 then you should invest in it. Example:- 1991 and 2008.

But when it is above 30 then don't invest in it.

What is Nifty 50?

It is the top 50 companies in India and its meaning is taken. It consists of the top 50 stocks from the Top 50 companies on the Stock Market, which are later used to find the Index. There are a total of 1600 companies in Nifty.

What is Sensex?

It is the top 30 companies in India and its meaning is taken. It consists of the top 30 stocks from the Top 30 companies on the Stock Market, which are later used to find the Index. There are a total of 6000 companies in Sensex.

Also, there is s&p 500 index which measures the top 500 companies which are indexed in the USA.

In the stock market, if intelligence is less it does not matter, but emotional intelligence should be strictly less. We get annual interest in the share market is 18 to 20% if you have fundamental and technical analysis knowledge.

What is IPO?

If the company wants to expand they ask for public demand or go for IPO Initial public offering, if the company earns extra profit then the company might also give dividends and extra shares.

When we discussed Stock Market Information we get two basics terms they are Bear and Bull. A bear market means when the market is receding and bull means when the market is growing.

There are 3 types of investment:-

- One-day trading i.e intraday trading.

- Few days to 6 months is short-term trading.

- Above 6 months is a long-term investment.

Also, make it clear before that there are no market makers in Stocks. no one can control the Market.

SEBI gives permission to IPO. A company needs to provide all details to SEBI. Then it keeps attention on all Exchanges National Stock Exchange, Bombay Stock Exchange, Company, Demat account, and people.

Index funds help you learn passive income strategy.

There are two types of trading in the Equity Market:-

- Delivery

- Intraday

In Delivery, you can take shares today but except on that day, you can sell it anytime you want, after 10 years or 20 years also.

But in Intraday the timing is 9:15 a.m. to 3:30 p.m. You must buy and sell between this time. Stop-loss is a must in intraday trading.

But if you don't sell your share before 3:30 p.m. then automatically that share gets sold at this time it is known as Swarrow. Experts say Intraday is known as trading and Delivery is known as investment.

F & O also known as Future and Option. It is to set the target on the basis of 3 days, 7 days, and 15 days.

The next one is the commodity which includes gold, silver, petrol, natural gas, and crude oil commodity. It is also part of the intraday.

The last one is the currency market it is also the part of intraday. We also can say commodity and currency as future and option trading.

Warren Buffet said 'Those who can't read Financial Statements should not purchase individual stocks.

Company balance sheets:-

1) Assets:- Which company owns eg. Machinery, the land company.

2) Liabilities:- Bank loan, Bonds, Equity shares.

Views of Experts in the Indian Stock Market:-

As per Bhushan Godbole sir, there is an 80:20 ratio where 80% are middle-class people and 20% belong to reach and extremely rich.

When it comes to 20% everyone invests in the stock market but when it comes to the middle class less than 25% invest and trade in the stock market. It is also known as the 'Pareto Principle. So experts say that from the last 10 years the stock market of India has given about 13 to 18% return.

The stock market also gives you contingency funds (saving funds) to capitalize on your home in times of problems. Money which we get from IPO is a Public limited company.

Also while taking IPO, ASBA happens which is known as an application supported by block amount if we get shares then our money gets cuts from Bank otherwise money gets unblock again and gets deposit in the bank.

|

| Investing in Nifty |

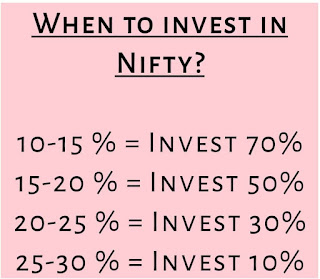

When to invest in Nifty?

10 - 15 % = Invest 70 %

15 - 20 % = Invest 50 %

20 - 25 % = Invest 30 %

25 - 30 % = Invest 10 %

You must know the boundaries but remember boundaries are not permanent in the stock market.

The stock market also can help you learn mutual funds.

The reason why the stock market fluctuates daily because of supply and demand. If good news comes or if there is a good performance in the company then demand increases. If bad news comes or bad performance in the company then supply increases.

If we purchase shares on Monday we get on Wednesday, if we purchase on Wednesday then we get on Friday this is called T + 2 that is the trading and settlement cycle.

Short Sell:- When you know that market will crash fix then you sell the stocks which aren't owned by you and later you buy it at a lower price.

Market Capitalisation:-

The current rate of stock X number of outstanding shares.

If the share price is rupees 10 and outstanding shares are 10000 then market capitalization will be 1 Lakh. This way they are listed as Large-cap, Midcap, and Small-cap. The value of money decides whether the company's stock is Large cap, Mid Cap, and Small-cap every time. Nowadays large-cap means 20000 crores and above eg. TCS and Infosys. Mid Cap means 5000 - 20000 crore and Small-cap names below 5000 crores.

Right issue:- To give shares again to those people who have already shared at a discount price to raise funds.

Dividend:- When the company is in profit it gives some amount to its shareholders is known as Dividend and company analysis "face value" and then declared it. It is best for long-term investment.

Bonus and Split:- If the share costs 2000 rupees and divided into 500 notes then the value remains the same, they are just split. If a company thinks there any share price has become too high they just split it. In bonus, the company gives you one more share in bonus but at half price. Means the number of share increases.

Record date and ex-date:-

When we get a dividend, bonus, split the exact date fix is so important i.e 10th so 10th is the record date. As India follows T + 2 cycles so it is important to take stock on the 8th, if we take on the 9th it will go in vain so the 9th is ex-date.

The investing brain has full knowledge of cash flow, statement, financial statement, balance sheets, fundamental analysis.

Trading Brain has knowledge of technical analysis, chart analysis, and trend analysis.

Share broker is the only person in the stock market who consistently earns from intraday while the common man has the ratio of just 60:40 in earning.

Event-based trading /Jackpot reading:- When there will be a budget in Parliament or election results will be declared that time in those two to three hours we need to see trade and trade according to it.

In the cash market we need to take only one single share also we are part of a dividend bonus and split.

But in the derivative market we need to take a lot of (10, 100, 1000) as per Company rule, and also we are not part of the dividend bonus and split.

Types of derivatives market:-

1) Future

2) Option

Conclusion:-

Today we discussed the stock market for beginners and provided all stock market information here. We described the basics of stocks and how the stock market works. Earning in the stock market is not easy as not hard but we need to have plenty of knowledge to do it.

Read also Biography of Anand Dighe

![Sensational Biography of [Sanjay Raval Financial Guru] - 2021](https://blogger.googleusercontent.com/img/b/R29vZ2xl/AVvXsEiN0hJfDjzWqOMkhniehvgDa09wBCk4cHfXpSPSyDhirUE1FnPxRu-HRAfsQKOJRkKJq8AA6xGDg3_WSteOSHgZaO1DAbtGO3-zS-aVEZph4pHXy5lxJ-c2YvCxuJmaLLyTaLtJ_rBsPNA6/w100/unnamed+%25282%2529.jpg)

0 Comments